Figure 1: Health Insurance Coverage Before and After Job Loss Among People in a Family Experiencing Job Loss as of May 2, 2020

Rachel Garfield, Gary Claxton, Anthony Damico, and Larry Levitt

Published: May 13, 2020 - Kaiser Family Foundation

The economic consequences of the coronavirus pandemic have led to historic level of job loss in the United States. Social distancing policies required to address the crisis have led many businesses to cut hours, cease operations, or close altogether. Between March 1st and May 2nd, 2020, more than 31 million people had filed for unemployment insurance. Actual loss of jobs and income are likely even higher, as some people may be only marginally employed or may not have filed for benefits. Some of these unemployed workers may go back to work as social distancing curbs are relaxed, though further job loss is also possible if the economic downturn continues or deepens.

In addition to loss of income, job loss carries the risk of loss of health insurance for people who were receiving health coverage as a benefit through their employer. People who lose employer-sponsored insurance (ESI) often can elect to continue it for a period by paying the full premium (called COBRA continuation) or may become eligible for Medicaid or subsidized coverage through the Affordable Care Act (ACA) marketplaces. Over time, as unemployment benefits end, some may fall into the “coverage gap” that exists in states that have not expanded Medicaid under the ACA.

In this analysis, we examine the potential loss of ESI among people in families where someone lost employment between March 1st, 2020 and May 2nd, 2020 and estimate their eligibility for ACA coverage, including Medicaid and marketplace subsidies, as well as private coverage as a dependent (see detailed Methods at the end of this brief). To illustrate eligibility as their state and federal unemployment insurance (UI) benefits cease, we show eligibility for this population as of May 2020 and January 2021, when most will have exhausted their UI benefits.

Eligibility for health coverage for people who lose ESI depends on many factors, including income while working and family income while unemployed, state of residence, and family status. Some people may be ineligible for coverage options, and others may be eligible but opt not to enroll. Some employers may temporarily continue coverage after job loss (for example, through the end of the month), but such extensions of coverage are typically limited to short periods.

Medicaid: Some people who lose their jobs and health coverage‘specially those who live in states that expanded Medicaid under the ACA・may become newly eligible1 for Medicaid if their income falls below state eligibility limits (138% of poverty in states that expanded under the ACA). For Medicaid eligibility, income is calculated based on other income in the family plus any state unemployment benefit received (though the $600 per week federal supplemental payment available through the end of July is excluded). Income is determined on a current basis, so prior wages for workers recently unemployed are not relevant. In states that have not expanded Medicaid under the ACA, eligibility is generally limited to parents with very low incomes (typically below 50% of poverty and in some states quite a bit less); thus many adults may fall into the “coverage gap” that exists for those with incomes above Medicaid limits but below poverty (which is the minimum eligibility threshold for marketplace subsidies under the ACA). Undocumented immigrants are ineligible for Medicaid, and recent immigrants (those here for fewer than five years) are ineligible in most cases.

s.Marketplace: ACA marketplace coverage is available to legal residents who are not eligible for Medicaid and do not have an affordable offer of ESI; subsidies for marketplace coverage are available to people with family income between 100% and 400% of poverty. Some people who lose ESI may be newly-eligible for income-based subsidies, based on other family income plus any state and new federal unemployment benefit received (including the $600 per week federal supplement, unlike for Medicaid).2 While current income is used for Medicaid eligibility, annual income for the calendar year is used for marketplace subsidy eligibility. Advance subsidies are available based on estimated annual income, but the subsidies are reconciled based on actual income on the tax return filed the following year. People who lose ESI due to job loss qualify for a special enrollment period (SEP) for marketplace coverage.3 As with Medicaid, undocumented immigrants are ineligible for marketplace coverage or subsidies. However, recent immigrants, including those whose income makes them otherwise eligible for Medicaid, can receive marketplace subsidies.

ESI Dependent Coverage: People who lose jobs may be eligible for ESI as a dependent under a spouse or parent’s job-based coverage. Some people may have been covered as a dependent prior to job loss, and some may switch from their own coverage to coverage as a dependent.

COBRA: Many people who lose their job-based insurance can continue that coverage through COBRA, although it is typically quite expensive since unemployed workers generally have to pay the entire premium ・employer premiums average $7,188 for a single person and $20,576 for a family of four ・plus an additional 2%. People who are eligible for subsidized coverage through Medicaid or the marketplaces are likely to opt for that coverage over COBRA, though COBRA may be the only option available to some people who are income-ineligible for ACA coverage.

Short-term plans: Short-term plans, which can be offered for up to a year and can sometimes be renewed under revised rules from the Trump administration, are also a potential option for people losing their employer-sponsored insurance. These plans generally carry lower premiums than COBRA or ACA-compliant coverage, as they often provider more limited benefits and usually deny coverage to people with pre-existing conditions. Even when coverage is issued, insurers generally may challenge benefit claims that they believe resulted from pre-existing medical problems; given the long latency between initial infection and sickness with COVID-19, these plans are riskier than usual during the current pandemic. People cannot use ACA subsidies toward short-term plan premiums.Our analysis examines eligibility for Medicaid, marketplace subsidies, and dependent ESI coverage. We do not estimate enrollment in COBRA, short-term plans, or temporary continuation of ESI. See Methods for more details.

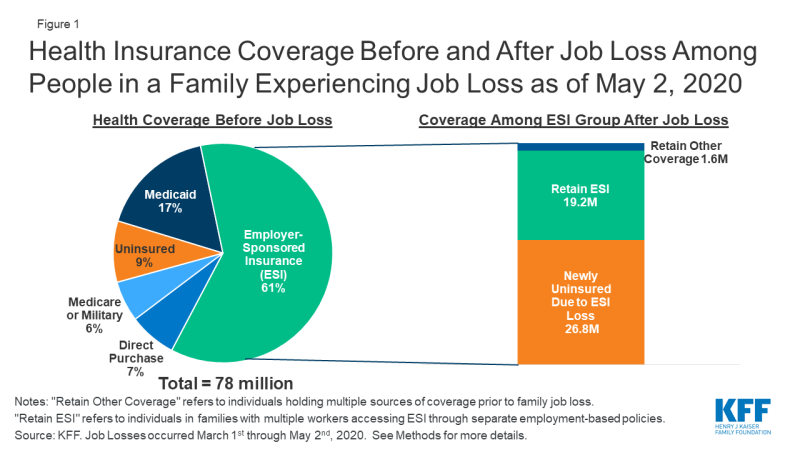

Between March 1st, 2020 and May 2nd, 2020, we estimate that nearly 78 million people lived in a family in which someone lost a job. Most people in these families (61%, or 47.5 million) were covered by ESI prior to job loss. Nearly one in five (17%) had Medicaid, and close to one in ten (9%) were uninsured. The remaining share either had direct purchase (marketplace) coverage (7%) or had other coverage such as Medicare or military coverage (6%) (Figure 1).

Figure 1: Health Insurance Coverage Before and After Job Loss Among People in a Family Experiencing Job Loss as of May 2, 2020

We estimate that, as of May 2nd, 2020, nearly 27 million people could potentially lose ESI and become uninsured following job loss (Figure 1). This total includes people who lost their own ESI and those who lost dependent coverage when a family member lost a job and ESI. Additionally, some people who otherwise would lose ESI are able to retain job-based coverage by switching to a plan offered to a family member: we estimate that 19 million people switch to coverage offered by the employer of a working spouse or parent. A very small number of people who lose ESI (1.6 million) also had another source of coverage at the same time (such as Medicare) and retain that other coverage. These coverage loss estimates are based on our assumptions about who likely filed for UI as of May 2nd, 2020 and the availability of other ESI options in their family (see Methods for more detail).

Among people who become uninsured after job loss, we estimate that nearly half (12.7 million) are eligible for Medicaid, and an additional 8.4 million are eligible for marketplace subsidies, as of May 2020 (Figure 2). In total, 79% of those losing ESI and becoming uninsured are eligible for publicly-subsidized coverage in May. Approximately 5.7 million people who lose ESI due to job loss are not eligible for subsidized coverage, including almost 150,000 people who fall into the coverage gap, 3.7 million people ineligible due to family income being above eligibility limits, 1.3 million people who we estimate have an affordable offer of ESI through another working family member, and about 530,000 people who do not meet citizenship or immigration requirements. We project that very few people fall into the coverage gap immediately after job loss (as of May 2020) because wages before job loss plus unemployment benefits (including the temporary $600 per week federal supplement added by Congress) push annual income for many unemployed workers in non-expansion states above the poverty level, making them eligibility for ACA marketplace subsidies for the rest of the calendar year.

Figure 2: Eligibility for ACA Coverage Among People Becoming Uninsured Due to Loss of Employer-Sponsored Insurance

By January 2021, when UI benefits cease for most people, we estimate that eligibility shifts to nearly 17 million being eligible for Medicaid and about 6 million being eligible for marketplace subsidies (Figure 2), assuming those who are recently unemployed have not found work. Many unemployed workers who are eligible for ACA marketplace subsidies during 2020 would instead be eligible for Medicaid or fall into the coverage gap during 2021. The number in the coverage gap grows to 1.9 million (an increase of more than 80% of its previous size), and the number ineligible for coverage due to income shrinks to 0.9 million.

Estimates of coverage loss and eligibility vary by state, depending largely on underlying state employment by industry and Medicaid expansion status. Not surprisingly, states in which the largest number of people are estimated to lose ESI are large states with many people working in affected industries (Appendix Table 1). Eight states (California, Texas, Pennsylvania, New York, Georgia, Florida, Michigan, and Ohio) account for just under half (49%) of all people who lose ESI. Five of the top eight states have expanded Medicaid, and people eligible for Medicaid among the potentially newly uninsured as of May 2020 in these five states account for 40% of all people in that group nationally. Overall, patterns by state Medicaid expansion status show that people in expansion states are much more likely to be eligible for Medicaid, while those in non-expansion states are more likely to qualify for marketplace subsidies (Figure 3). However, the number of people qualifying for marketplace subsidies is similar across the two sets of states, as more people live in expansion states. Three states that have not expanded Medicaid, including Texas, Georgia, and Florida, account for 30% of people who become marketplace tax credit eligible nationally in May 2020. Assuming unemployment extends into 2021 when UI benefits would likely expire for most families, the proportion eligible for Medicaid would increase in expansion states while non-expansion states may see more nonelderly adults moving into the Medicaid coverage gap (Figure 4; Appendix Table 2).

Figure 3: May 2020 Eligibility for ACA Coverage among People Becoming Uninsured Due to Loss of Employer-Sponsored Insurance, by State Medicaid Expansion Status

Figure 4: January 2021 Eligibility for ACA Coverage among People Becoming Uninsured Due to Loss of Employer-Sponsored Insurance, by State Medicaid Expansion StatusNearly 7 million people losing ESI and becoming uninsured are children, and the vast majority of them are eligible for coverage through Medicaid or CHIP. Within the 26.8 million people losing ESI and becoming uninsured in May 2020, 6.1 million are children. Because Medicaid/CHIP income eligibility limits for children are generally higher than they are for adults, the vast majority of these children are eligible for Medicaid/CHIP in May 2020 (5.5 million, or 89%) or January 2021 (5.8 million, or 95%).

Discussion

Given the health risks facing all Americans right now, access to health coverage after loss of employment provides important protection against catastrophic health costs and facilitates access to needed care. Unemployment Insurance filings continue to climb each week, and it is likely that people will continue to lose employment and accompanying ESI for some time, though some of them will return to work as social distancing curbs are loosened. The ACA expanded coverage options available to people, and we estimate that the vast majority of people who lose ESI due to job loss will be eligible for ACA assistance either through Medicaid or subsidized marketplace coverage. However, some people will fall outside the reach of the ACA, particularly in January 2021 when UI benefits cease for many and some adults fall into the Medicaid coverage gap due to state decisions not to expand coverage under the ACA.

Both ACA marketplace subsidies and Medicaid are counter-cyclical programs, expanding during economic downturns as people’s incomes fall. In return for additional federal funding to help states finance their share of Medicaid cost during the public health crisis, states must maintain eligibility standards and procedures that were in effect on January 1, 2020 and must provide continuous eligibility through the end of the public health emergency, among other requirements. These provisions may help eligible individuals enroll in and maintain Medicaid, particularly in light of state and federal actions prior to the crisis to increase eligibility verification requirements or transition people off Medicaid.

Our estimates only examine eligibility among people who lost ESI due to job loss and potentially became uninsured. Additional uninsured individuals(ncluding some of the 9% of the 78 million individuals in families where someone lost employment[ay also be eligible for Medicaid or subsidized coverage. It is possible that contact with state UI systems may lead them to seek and enroll in coverage, even if they were eligible for financial assistance before job loss but uninsured.

It is unclear whether people losing ESI and becoming uninsured will enroll in new coverage. We did not estimate take-up or enrollment in coverage options but rather only looked at eligibility for coverage. Even before the coronavirus crisis, there were millions of people eligible for Medicaid or marketplace subsidies who were uninsured. Eligible people may not know about coverage options and may not seek coverage; others may apply for coverage but face challenges in navigating the application and enrollment process. Still others may find marketplace coverage, in particular, unaffordable even with subsidies. As policymakers consider additional efforts to aid people, expanding outreach and enrollment assistance, which have been reduced dramatically by the Trump Administration, could help people maintain coverage as they lose jobs.This is the first economic downturn during which the ACA will be in place as a safety net for people losing their jobs and health insurance. The Trump Administration is arguing in case before the Supreme Court that the ACA should be overturned; a decision is expected by next Spring. The ACA has gaps, and for many the coverage may be unaffordable. However, without it, many more people would likely end up uninsured as the U.S. heads into a recession.